If you’ve been considering an HVAC upgrade and are looking at heat pumps, we’ve got great news. The Inflation Reduction Act (IRA) offers significant tax credits and rebates that can help you make upgrades to lower your carbon footprint and make your home more energy-efficient.

These IRA incentives will help Salt Lake City homeowners:

• Save money on monthly energy bills

• Receive huge rebates and tax incentives

• Have cleaner, healthier indoor air

By replacing old, outdated, and inefficient heating and cooling systems and equipment, homeowners in Salt Lake City can reduce the energy they’re using and save money in the long run. And now the IRA makes it more affordable!

Get Pumped for Heat Pump & HVAC savings

A heat pump offers significant savings over a furnace/air conditioner combination. Heat pumps can save the average American homeowner around $10,000 over 15 years. The savings are closer to $15,000 over 15 years if your home currently uses electric heat such as baseboard, an electric furnace, propane, or fuel oil.

For more immediate savings, you should look at the tax credits offered through the IRA. Tax credits went into effect Jan. 1, 2023, and rebates became available for equipment and installation purchases later in the year.

Here are the tax credits you may qualify for:

Heat Pumps

When you install a heat pump, you’re essentially replacing and upgrading two systems — your furnace and air conditioner.

Heat pumps are extremely energy efficient compared to traditional natural gas furnace and air conditioners most homes use. A heat pump has some advantages over other types of heating and cooling systems:

• Because it’s one unit that provides both warm and cool air, you save money by not purchasing and maintaining two units, and it takes up less space.

• Heat pumps are low-maintenance and only require a system check once a year. The check can be done by the homeowner, saving you money in the long run.

• Because no fossil fuels are used to run a heat pump, there are no fumes being released into the air. This carbon footprint reduction helps the environment. It also saves you money by removing natural gas (or propane or other fuel types) from your bills.

Air Conditioner

If you don’t choose a heat pump, the latest air conditioners can also save you significant money on your energy bill, in addition to reducing carbon pollution. Ask Whipple Service Champions what they recommend for homeowners in Salt Lake City, Utah.

Furnace

For some households, a heat pump doesn’t make sense for the structure of the home or the environment. An energy-efficient furnace may make more sense in this situation. If you’re in the market for a furnace upgrade, you can save up to $600 with the tax credits included in the Inflation Reduction Act.

Contact Whipple Service Champions to have a pro assess your HVAC system and make recommendations.

Inflation Reduction Act Heat Pump & HVAC 25C Tax Credits in 2024

Energy-Efficiency Home Improvement 25C Tax Credit

The IRA expanded and extended some existing tax credit and deduction programs. One of the biggest is the 25C tax credit, also called the Energy-Efficiency Home Improvement Tax Credit.

The 25C tax credit has been increased to cover 30% of the total cost of new energy-efficient qualified systems for 2024. The 25C tax credit went into effect on Jan. 1, 2023, for all homeowners.

As a homeowner in Salt Lake City, scheduling a heat pump installation or HVAC upgrade with Whipple Service Champions in 2024 means you’ll be able to deduct 30% of your total costs, with a total cap of $3,200 in tax credits, up to a maximum of $2,000 for a heat pump, when filing your taxes.

Home Owner Managing Energy Savings (HOMES) Whole-House Rebates (The HOMES Rebate Program)

The 25C program isn’t the only new incentive from the Inflation Reduction Act. Another program that became available later in 2023 is known as the HOMES rebate. This is a whole-home, performance-based rebate, meaning the more energy you save by making upgrades, the more money you get back.

Everyone in Salt Lake City qualifies for the HOMES Rebate, but low- and medium-income households can get more back. This program provides rebates based on the percentage of energy savings.

This program is capped at $8,000 for low- to middle-income households earning less than 80% of area median income who cut energy use by 35%.

NOTE: The HOMES rebate cannot be combined with the HEEHRA Rebates, but can be combined with the Inflation Reduction Act tax credits.

Contact us to schedule an appointment and see how you can save money with a heat pump or other HVAC upgrade and have this rebate apply to you.

High-Efficiency Electric Home Rebate Act (HEEHRA)

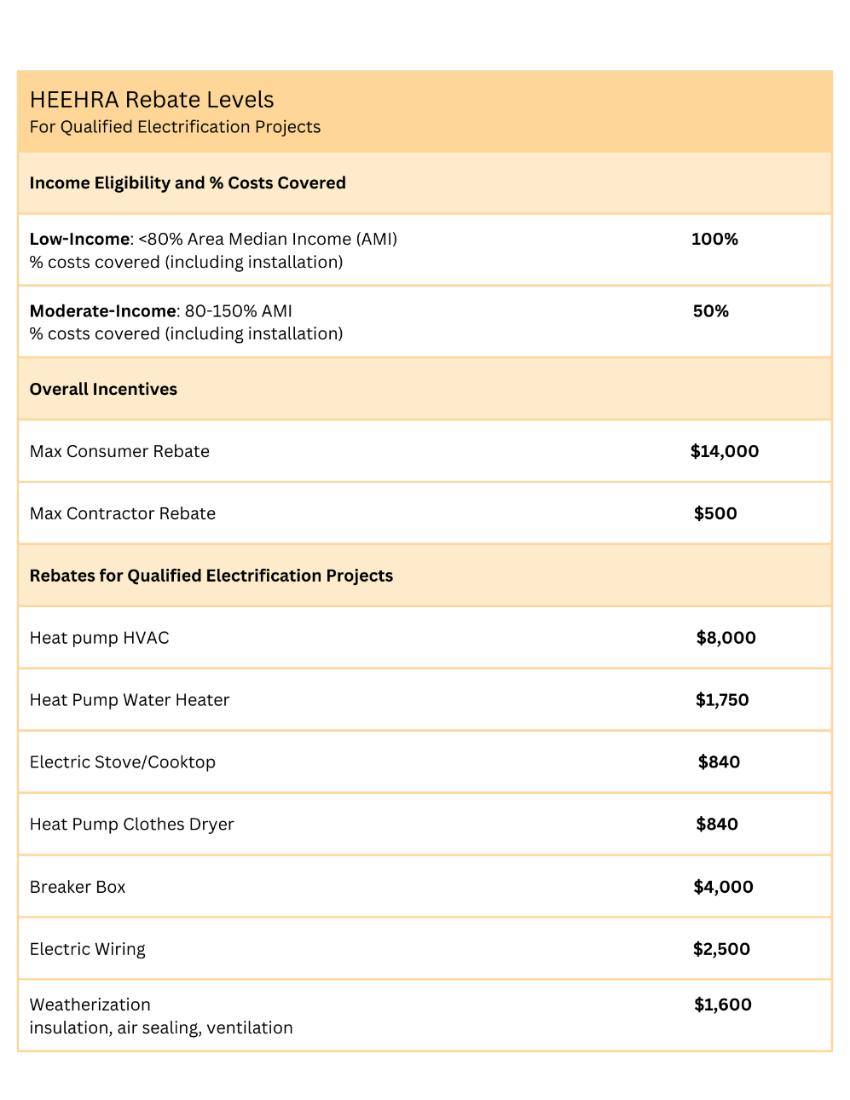

Another provision of the Inflation Reduction Act that can be used for installing a heat pump and other HVAC upgrades is the High-Efficiency Electric Home Rebate Act (HEEHRA). This offers as much as $14,000 per year in point-of-sale discounts (not tax deductions) for electrical projects. These are discounts when the purchase is made.

These discounts are capped at 50% of qualifying costs for a household that makes between 80% and 150% of area median income. If your household makes below that threshold in income, HEEHRA covers 100% of qualifying costs up to $14,000.

While the IRA specifically prohibits combining other rebates (the HOMES Rebate and the HEEHRA rebate cannot be combined), you’re allowed to claim HEEHRA rebates and tax credits.

Like the HOMES Rebate program, funds for the HEEHRA became available later in 2023. It’s up to individual states to determine if HEEHRA rebates will be retroactive. Low-income households will receive larger and more accessible up-front discounts from HEEHRA than the HOMES rebate.

Contact Whipple Service Champions to schedule an appointment and see how you can upgrade your house and save with the HEEHRA or HOMES rebates.

Get Answers to All Your Heat Pump, HVAC & IRA Questions at Whipple Service Champions

Our experts are trusted and know the ins and outs of the IRA rebates and tax incentives that will apply to your situation. The IRA rebates and incentives apply to heat pumps to heat and cool your house, HVAC upgrades, and many other energy-efficient home upgrades.

Let Whipple Service Champions help you choose the right system for your home and work with you on what IRA tax rebates apply.

Contact us to make an appointment or ask us questions about how to take advantage of the Inflation Reduction Act.

Read more about how the Inflation Reduction Act can save you money on electrical and plumbing upgrades in Salt Lake City.

Read more on what IRA tax rebates and tax credits mean for you.