How the Inflation Reduction Act Can Save You Money on Electrical & Plumbing Upgrades

If you’ve been considering making electrical and/or plumbing upgrades to your home, 2024 is your year. The Inflation Reduction Act (IRA) offers significant tax credits and rebates that can help you make upgrades to lower your carbon footprint and make your home more energy-efficient.

In addition to helping reduce the effects of carbon pollution, the Inflation Reduction Act will help homeowners in Salt Lake City who want to make energy-efficient upgrades.

The IRA provides generous funding in the form of tax credits and rebates on qualifying purchases, and you’ll also save money on your utility bills in the long run.

How the IRA Can Save You Money on Electrical & Plumbing Home Improvements

Replacing old electrical systems or water heaters can save you money in the long run on your energy bills. However, the Inflation Reduction Act can save you over $17,000 per year in tax credits and rebates on qualifying purchases.

Electrical Panel Updates

Electrical panels (also referred to as panelboard, sub panelboard, or breaker boxes) are connected to your home’s main power supply and distribute electricity to various parts of your home. They’re easy to take for granted as long as they’re working properly, but there are simple upgrades you can make for better energy efficiency and cost savings.

If your home is over 25 years old and your electrical panel is part of the original wiring, it’s probably time for an upgrade. Today’s households generally have more powered appliances that need electricity, so older homes may need upgraded panels to keep up.

While electrical work may seem daunting, it’s an important way to keep your family safe and save money and energy.

Contact Whipple Service Champions to get an expert assessment of the panel upgrades that are best for your home.

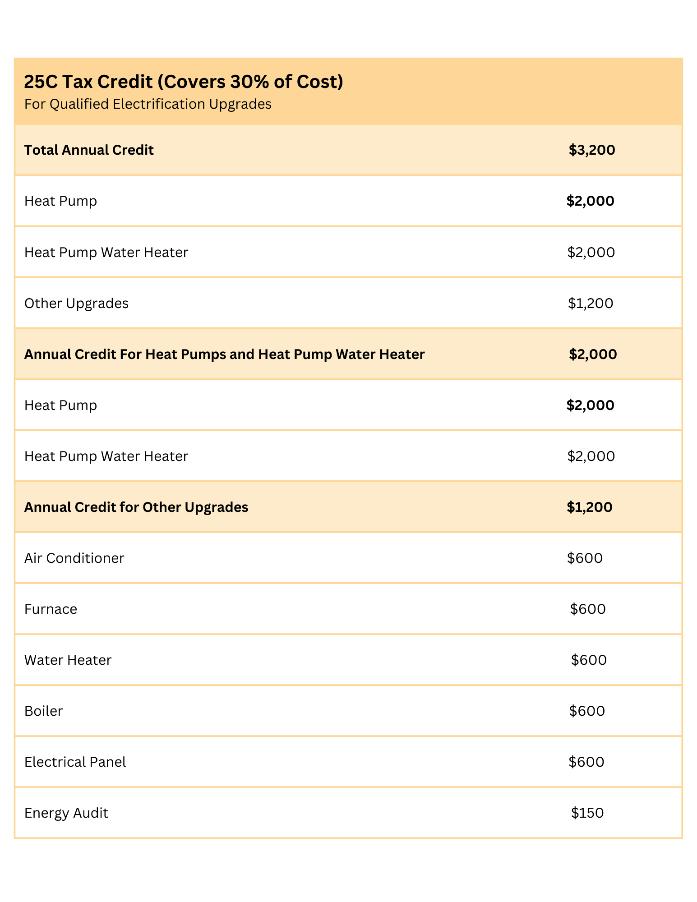

IRA tax credit for electrical panels: The IRA provides a tax credit of up to $600 for homeowners who upgrade their electrical panels in conjunction with any qualified energy property or upgrade covered in the Energy-Efficient Home Improvement Tax Credit (25C). You’ll find more information on this credit below.

Water Heater Upgrades & Heat Pump Water Heaters

If your water heater is over 15 years old, now is a good time to look into getting it replaced. Older models tend to break down and there are newer options that are more efficient, meaning you’ll use less water and save money on bills.

Whether you choose a fuel-powered appliance or a newer heat pump water heater depends on several factors, including the size of your home and your typical water usage. Conventional water heaters are fueled by natural gas, oil, or propane, and heat water in a tank so it’s ready when you need it.

Heat pump water heaters work by moving heat from one place to another, rather than directing heat specifically for hot water. This makes them more energy efficient, and you can see significant savings on your energy bill.

Whipple Service Champions will inspect your current water heater setup and recommend what will work best for you.

Inflation Reduction Act tax credit for water heaters: The IRA provides a tax credit of $600 for water heaters that use natural gas, oil, or propane, and up to $2000 for heat pump water heaters.

Here’s a great savings calculator from Rewiring America that will show you how much you can save by making energy-efficient changes to your home.

IRA 2024 Tax Credits for Electrical & Plumbing Upgrades

Energy-Efficiency Home Improvement Tax Credit (25C)

The IRA offers homeowners-specific tax credits — up to 30% — on home improvements under the Energy-Efficiency Home Improvement Tax Credit.

This means any energy-efficient plumbing and electrical updates you make, starting on Jan. 1, 2023, will be eligible for a credit of up to 30% of the total cost, up to $3200 per year on your federal tax return.

Whipple Service Champions can provide documentation on your new upgrades to claim these credits when you work with us for electrical and plumbing upgrades.

IRA Rebates for Electrical & Plumbing Upgrades

The IRA also includes money for rebates on the purchase of new energy-efficient electrical and plumbing appliances and installation. These rebates will be available later in 2023.

HOMES rebate

The HOMES (Home Owner Managing Energy Savings) rebate is a whole-home, performance-based rebate, meaning that the more energy you save by making upgrades, the more money you get back.

For example, depending on where you live and your median family income, you can save up to $8000 when you cut your energy use by 35%. Everyone in Salt Lake City qualifies for the HOMES Rebate, but low- and medium-income households can get more back. This program provides rebates based on the percentage of energy savings.

NOTE: The HOMES rebate can’t be combined with the HEEHRA Rebates, but can be combined with the Inflation Reduction Act tax credits.

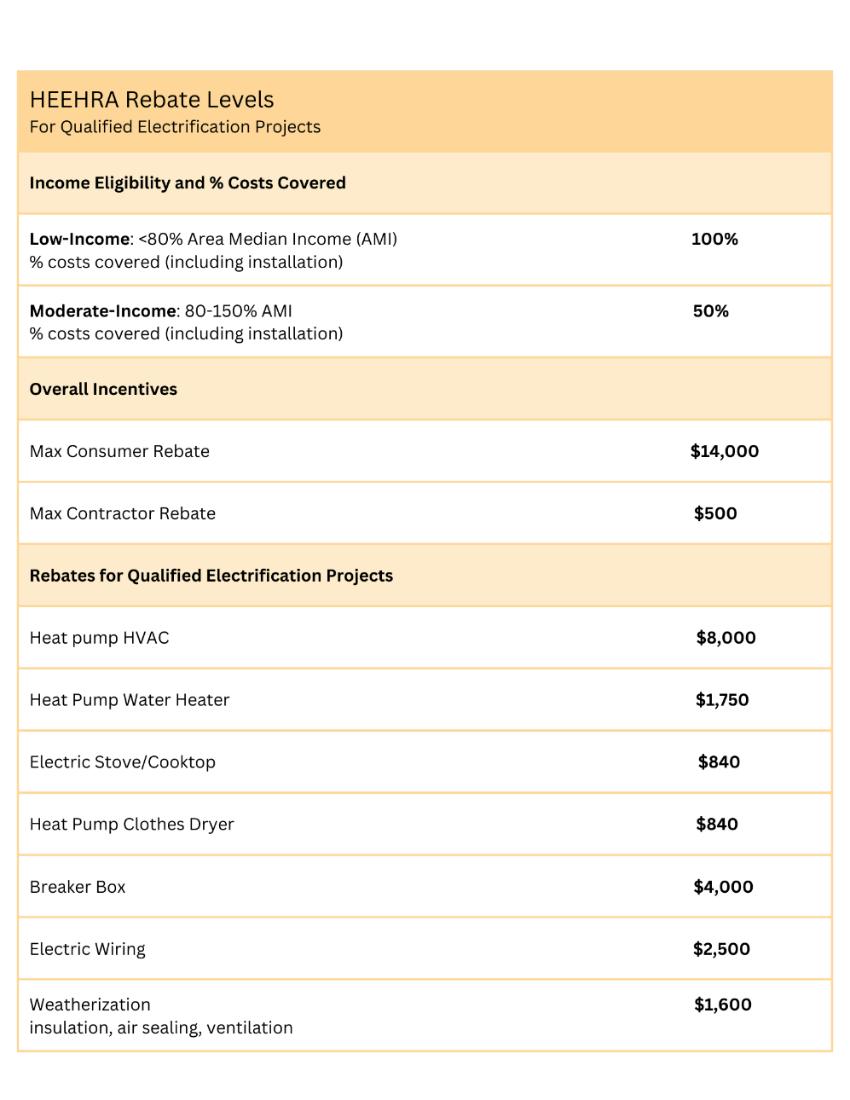

HEEHRA rebate

The High-Efficiency Electric Home Rebate Act (HEEHRA) offers as much as $14,000 per year in point-of-sale discounts (not tax deductions) for energy-efficient home improvement projects. Like the HOMES rebate, these savings are applied at the point of purchase and are off-the-top discounts.

Depending on your household income, HEEHRA rebates can cover anywhere from 50% to 100% of qualifying costs, up to $14,000.

NOTE: You’re allowed to claim HEEHRA rebates and tax credits.

Contact Whipple Service Champions today to see what kind of energy-saving — and money-saving! — options are available for your household.

Whipple Service Champions Has the Electrical, Plumbing & IRA Answers You Need

Our experts are trusted in Salt Lake City, Utah, and know the ins and outs of the IRA rebates and incentives that will apply to your situation. We’ll ensure you receive the rebates you qualify for.

Whether you want to make electrical upgrades, find a better water heater for your home, upgrade your electrical panel, or just have questions about these kinds of projects, we can help you choose the right system for your home and work with you on what IRA tax credits and rebates apply.

Contact us to make an appointment or ask us questions about how you can take advantage of the Inflation Reduction Act.

Read more about what the Inflation Reduction Act tax credits and rebates mean for you.

Read more about the Inflation Reduction Act savings on heat pump and HVAC upgrades in Salt Lake City.